India’s Leading Institute for Stock Market Education, Technical Mastery & Astrofinance – AIFM

If you're passionate about trading and investing in the stock market and are looking for the right institute to guide your journey, AIFM (Astroedge Institute of Financial Market) is your one-stop destination. As a premier stock market coaching institute, AIFM offers a complete learning ecosystem designed to take you from beginner to pro across Equity, Technical Analysis, Derivatives (F&O), Commodities, Currencies, and more.

ASTROEDGE INSTITUTE OF FINANCIAL MARKET

Contact With Our Professional - 8178390558, 9717276934

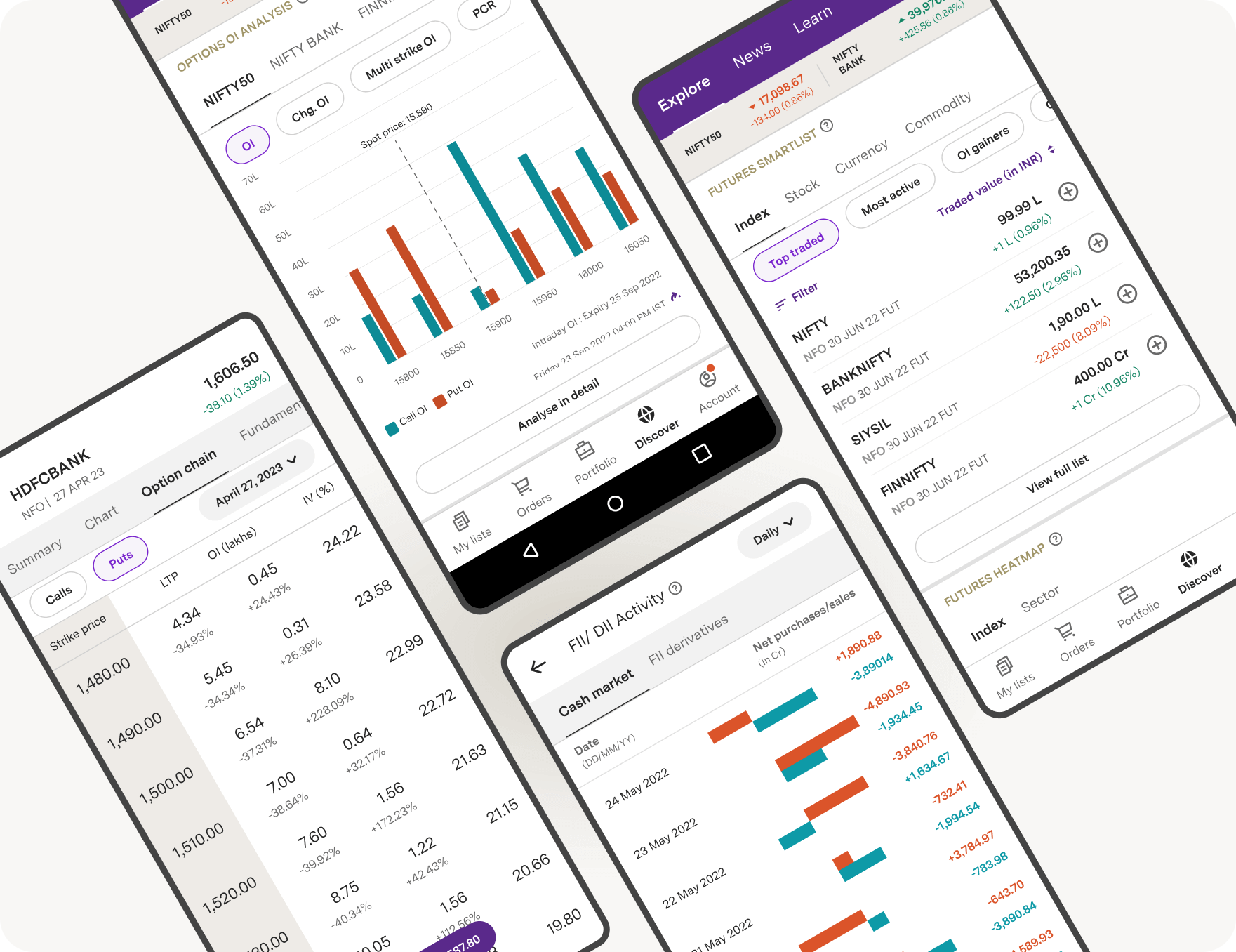

Enhance your workflow and productivity

Boost your trading skills and productivity with our Stock Market Institute.

Certified Programs

Certification adds credibility. Recognized courses which can open doors to professional opportunities in broking, research, and fund management.

Advanced Tools Training

Training on real-world platforms like Trading View, Ami broker helps students become tech-savvy and ready to implement strategies using actual tools.

Personalized Learning Path

Every learner is different—some are part-time investors, others are aspiring full-time traders. Tailored content and mentorship ensure each student progresses according to their goals and pace.

What Sets AIFM Apart?

Complete Stock Market Education

From the basics of equity market Fundamental to advanced options trading strategies, technical indicators, and intermarket analysis—our curriculum is designed for every level.

In-Depth Technical & Fundamental Analysis

Master the fundamentals and strategies of trading in derivatives, commodities, and currency markets.

Get hands-on experience with live market simulations and real-time analysis.

Earn a professional certification to enhance your resume and career prospects in the financial sector.

Mastery in Astrofinance & W.D. Gann Studies

Learn the rare art of forecasting tops, bottoms, reversal dates, and intraday turning points using planetary cycles, time-based theories, and geometric price models.

-

Explore the fusion of astrology and financial markets by learning how planetary cycles and astrological patterns influence price movements, as used in Astrofinance.

-

Understand and apply W.D. Gann's time-tested techniques such as Gann angles, square of nine, and time cycles to predict market trends with greater accuracy.

Astrofinance & Gann Theory Integration

Unique to institutes like AIFM, blending financial astrology and time cycles with technicals provides an edge in forecasting market movements.

Regular Forecast Sessions

Monthly and weekly Astro-Market Outlooks to prepare for upcoming trends based on planetary events and market cycles.

Trading Psychology Modules

Mastering emotions like fear, overconfidence is key to long-term success. Institutes that teach mental discipline,and behavioral patterns give students a huge edge.

Strategy Building Workshops

Students don’t just copy others—they learn to build their own strategies based on risk profile and capital. Strategy-building modules include backtesting and journaling.

7k

Followers/students

89%

Satisfaction or success rate

9.20

Average rating or trust score

.jpg)

Professional Training in Derivatives, Commodities & Currencies

Our comprehensive training program in Derivatives, Commodities, and Currencies is designed for individuals looking to build a solid foundation in financial markets. This course will help you understand the core concepts of trading, risk management, and market analysis, enabling you to navigate the complex world of financial instruments confidently.

Live Market Training & Mentorship

Our Live Market Training & Mentorship program is designed to provide you with real-time exposure to financial markets while being guided by industry experts. This hands-on learning approach helps you bridge the gap between theory and practical application, ensuring you gain the confidence to trade independently.

-

Real-Time Market Exposure: Participate in live market sessions where you will observe and analyze market movements, execute trades, and make informed decisions under expert guidance.

-

Practical Learning: Engage in real-time market scenarios, develop strategies, and solve live trading challenges to understand market behavior and improve decision-making skills.

The Complete Solutions

Practical Approach

Live market exposure is a must. Institutes that emphasize hands-on training through simulated trading, case studies, or live market hours help students gain confidence in applying concepts like technical analysis, chart reading, and order execution.

Best Support

Responsive mentorship, dedicated doubt-solving sessions, and 24/7 online support ensure students never feel stuck. Support also includes regular feedback on trading performance and access to expert consultations.

Comprehensive Courses

AIFM institutes offer end-to-end training across multiple asset classes—Equity, Technical Analysis. Futures & Options, Commodities, Currency, and sometimes even—so learners are fully equipped to trade anything.

Live Trading Labs

Real-time trading sessions under expert guidance teach order execution, entry/exit timing, trade management, and reaction to live news or volatility. This is where theory becomes reality.

Regular Webinars & Market Outlook Sessions

Live weekly or monthly sessions on current market trends, trading opportunities, and macro analysis help learners stay ahead of the curve and continuously upskill.

Internship & Placement Assistance

For students looking to build a career in trading firms, brokerages, or financial services, internship opportunities and job placements are a huge plus.

Lifetime Access & Alumni Support

AIFM institutes offer lifetime access to course updates, community forums, alumni groups, and continued support even after the program ends.

Complete Trader Transformation Program

This program blends theory with real-time market exposure, expert-led trading labs, and lifetime support.

Why AIFM is the Right Choice for You

Real-Time Chart Practice and Market Strategy Sessions

Updated Course Material with Practical Focus

Industry-Experienced Faculty

Access to Recordings, PDFs & Lifetime Community Support

Weekend & Weekday Batches Available (Online + Offline)

Interactive Learning & Market Simulations

Comprehensive Risk Management Training

Post-Course Career Support

Build a Strong Foundation of Knowledge

Start by learning the fundamentals of financial markets, including equities, derivatives, commodities, and currencies. Master key concepts like technical analysis, fundamental analysis, risk management, and trading psychology. Enrol in a structured course or institute (like AIFM) that offers comprehensive education from beginner to advanced levels.

Develop & Backtest a Trading Strategy

Create a trading strategy that suits your personality, risk tolerance, and time availability. Use historical data to backtest your strategy and analyze its performance. Understand key metrics like win rate, risk-reward ratio, and drawdowns. A disciplined, well-tested system is the backbone of professional trading.

Practice with Real Discipline and Capital Management

Start with paper trading or a small live account to build confidence. Focus on consistency rather than quick profits. Implement strict risk management (e.g., never risk more than 1–2% of your capital per trade) and keep a trading journal to review and improve your performance regularly. Emotional control and discipline are what separate amateurs from professionals.

What Our Students Say About AIFM

Trusted by Thousands of Aspiring Traders

"AIFM gave me real-world trading knowledge that no other institute could. The live market sessions were a game changer."

"The mentors here are true market professionals. They made chart reading and indicators so easy to understand."

"I was a complete beginner, but thanks to AIFM’s weekend batch, I built a strong foundation and now trade confidently on my own."

"The course content is up-to-date and highly practical. Plus, lifetime support and access to community groups make a big difference."

"The real-time strategy sessions completely transformed my trading mindset. AIFM gave me the confidence I needed."

"I used to think the stock market was only for experts, but AIFM taught me everything step by step and made it simple."

"PDFs, recorded lectures, and constant mentor support were always available. A great experience for anyone serious about trading."

"I was in losses before, but after learning risk management from AIFM, my trades have started turning profitable."

Questions & Answers

1. What is the stock market?

The stock market is a platform where buyers and sellers trade shares of publicly listed companies. It reflects the overall performance of an economy and helps individuals grow their wealth through investments. At AIFM Institute, we help you understand its complexities.

2.Can beginners start trading in the stock market?

Yes, beginners can start trading with proper guidance and education. At AIFM Institute, we start from the basics, helping you build confidence step-by-step before diving into real trading.

3. What is the difference between investing and trading?

Investing involves holding stocks for the long term to benefit from company growth, while trading focuses on short-term price movements. AIFM Institute teaches both strategies to help you choose the right path.

4. What is technical analysis in the stock market?

Technical analysis involves studying price charts and indicators to predict future market trends. At AIFM Institute, we teach you how to use this powerful tool to make informed decisions.

5. How much capital is required to start trading?

You can start with as little as ₹50,000 to ₹1,00,000. AIFM Institute recommends starting with a small amount and gradually increasing as you gain experience and confidence.

6.Is the stock market safe to invest in?

While the stock market involves risk, proper research, strategy, and risk management—skills taught at AIFM Institute—can significantly reduce those risks and improve your chances of long-term success.